Share

Debt information

Debt and financing

The objective of Kalmar treasury management is to secure sufficient funding for business operations, avoid financial constraint at all times, provide business units with financial services, minimise the costs of financing, manage financial risks (currency, interest rate, liquidity and funding, credit and counterparty risks as well as operational risks) and to provide management with information on the financial position and risk exposures of Kalmar and its business units.

Key figures

Net debt

Net debt 31 December 2025, MEUR

|

Loans from financial institutions |

200 |

|

Lease liabilities |

81 |

|

Other interest-bearing liabilities |

6 |

|

Total interest-bearing liabilities |

286 |

|

Loans receivable and other interest-bearing assets |

-3 |

|

Cash and cash equivalents |

-278 |

|

Total interest-bearing assets |

-281 |

|

Interest-bearing net debt |

5 |

|

Equity |

781 |

|

Gearing |

1% |

Liquidity

Kalmar's liquidity and funding position is strong. Table below illustrates Kalmar’s liquidity position.

Liquidity 31 December 2025, MEUR

|

Cash and cash equivalents |

278 |

|

Committed long-term undrawn revolving credit facility |

200 |

|

Liquidity reserve |

478 |

|

Repayments of interest-bearing liabilities in the following 12 months |

-24 |

|

Liquidity |

454 |

In addition, Kalmar has access to a EUR 150 million Finnish commercial paper programme. Kalmar may issue commercial papers with a maturity of less than one year within the facility.

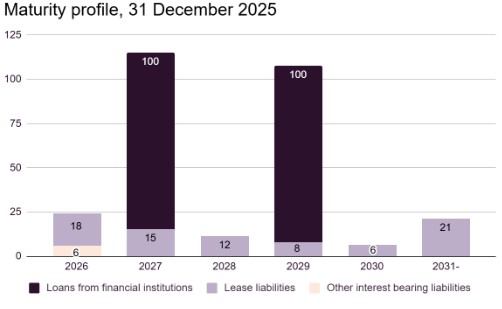

Interest-bearing liabilities

Kalmar held EUR 200 million of loans from financial institutions, EUR 81 million of lease liabilities, and EUR 6 million of other interest-bearing liabilities.

Average interest rate of interest-bearing liabilities excluding on-balance sheet lease liabilities was 3.1%.

Revolving credit facility

Kalmar Corporation has access to a EUR 200 million revolving credit facility with a syndicate of its six relationship banks. The facility matures in 2030 and includes an unused one-year extension option subject to the lender’s approval.

Covenants

The financing arrangements contain a financial covenant (net debt to equity), which restricts the capital structure. According to the covenant, Kalmar’s net debt to equity must be retained below 125%.

Credit ratings

Kalmar has not applied for a credit rating from any rating agency.

You need to accept targeting cookies before you can view the YouTube content. Those cookies may be used to show you relevant content and adverts. Click the button “Cookie Settings” to manage your preference.